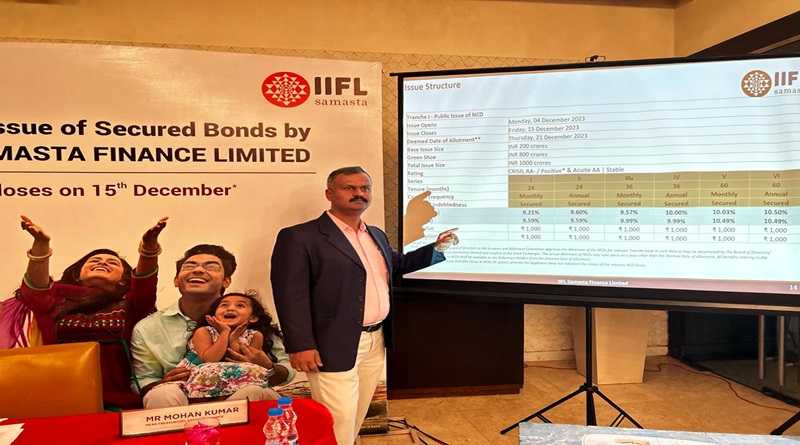

IIFL Samasta plans to raise up to Rs. 1,000 crores through bonds, offering a potential return of up to 10.50% per annum

New Delhi: IIFL Samasta Finance, a major NBFC-MFI in India, plans to raise Rs. 1,000 crores through its first public issue of secured bonds for business growth. The bonds offer up to 10.50% returns with a high level of safety. The issue period is from December 4 to December 15, 2023. IIFL Samasta is a part of IIFL Finance, one of India’s largest retail-focused NBFCs with loan assets totaling Rs. 73,066 crores.

IIFL Samasta Finance will issue Rs. 200 crores in bonds with a green-shoe option for oversubscription up to Rs. 800 crore, totaling Rs. 1,000 crores. The bonds offer a 10.50% annual coupon rate for a 60-month tenor. Available in tenors of 24, 36, and 60 months, interest payment frequencies include both monthly and annual options for each series.

Mr Mohan Kumar, Head – Treasury, IIFL Samasta Finance said, “IIFL Samasta Finance has a strong physical presence of across India through about 1,500 branches. It caters to the credit needs of underserved and unserved population, primarily women entrepreneurs from underprivileged background through a well-diversified portfolio. The funds raised will be used to meet credit demand from more such customers and bolster business growth.”

IIFL Samasta Finance provides affordable financial products to women in unbanked sections through Joint Liability Groups. This includes a diverse range of occupations across rural, semi-urban and urban areas in India.

Pingback: ผ้า

Pingback: จอ led ขนาดใหญ่

Pingback: หวยลาว สลากพัดทะนา คืออะไร ?

Pingback: Sofwave รีวิว

Pingback: 토토 신규가입머니 지급

Pingback: รักษาสิว

We are a group of volunteers and opening a new scheme in our community. Your site provided us with valuable information to work on. You’ve done a formidable job and our whole community will be grateful to you.

Pingback: lsm44

Pingback: บ้านพักคนงาน

Pingback: สินเชื่อรถบรรทุก

Absolutely composed written content, thankyou for selective information.

Pingback: ไม้พื้น

Pingback: เอเย่นส์ Sbobet ในไทยมีเว็บไหนบ้าง

Pingback: สล็อตเกาหลี

Pingback: เว็บปั้มไลค์

Pingback: Panzer Arms USA

Pingback: m358 เว็บตรง อันดับ 1 ขวัญใจคนไทย

Pingback: เช่ารถตู้พร้อมคนขับ

Pingback: โอลี่แฟน

Saved as a favorite, I really like your blog!

Pingback: Aviator game

Pingback: https://www.icandcminerals.com/2025/03/02/pocket-option-trading-platform-a-comprehensive/

An attention-grabbing discussion is price comment. I believe that you should write more on this matter, it won’t be a taboo topic but usually persons are not enough to speak on such topics. To the next. Cheers

Pingback: fox888

Pingback: DeepNude ai

Pingback: เว็บปั้มไลค์

Pingback: บริการส่ง SMS

Pingback: บ้านพักคนชรา

Pingback: book fo ra