Fin One Young Indians’ Saving Habits Outlook 2024: 43% of Kochi’s youth start investing by 22-25, with almost 34% saving 30% of their income

Kochi: Fin One, a digital-first initiative by Angel One Limited (NSE: ANGELONE; BSE: 543235), has released its Fin One Young Indians’ Saving Habits Outlook 2024, shedding light on the evolving financial behaviours of Millennials and Gen Z across India. The data for the report was compiled by the leading research firm, Nielsen Media. The report examines saving patterns, investment preferences, and the influence of technology on financial habits among Kochi’s young residents. Findings show a strong inclination towards traditional financial methods, with 34% of young adults saving more than 30% of their income each month—a testament to Kochi’s disciplined financial culture.

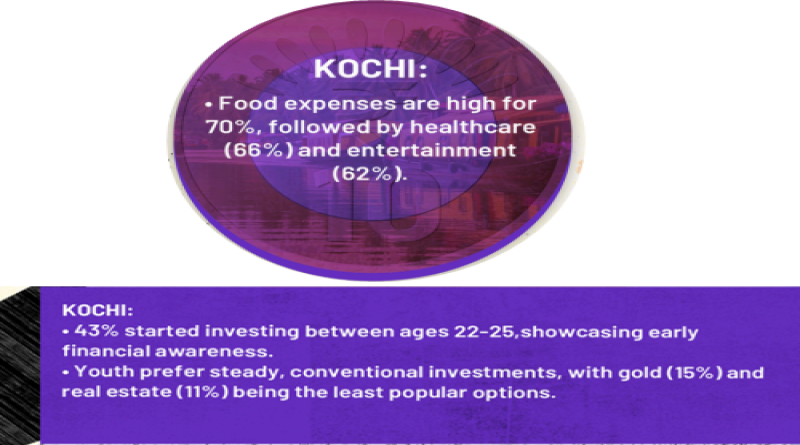

Kochi’s youth prioritize savings accounts over other investment options, underscoring a conservative approach towards finance. Food expenses dominate spending for 70% of respondents, followed closely by healthcare and entertainment, reflecting a focus on essential and lifestyle costs.

Key Highlights from Kochi:

- Savings Culture: A third of Kochi’s young adults save over 30% of their income, with 62% favouring traditional savings accounts over stocks (46%) and mutual funds (43%), highlighting it as their preferred investment method.

- Investment Preferences: Kochi’s youth show a preference for steady, conventional investments. Besides savings accounts, stocks and mutual funds are also popular, while gold (15%) and real estate (11%) hold the lowest interest.

- Spending Priorities: Food expenses are at an all-time high for 70% of respondents, followed by healthcare (66%) and entertainment (62%), highlighting a balanced focus on essential and discretionary spending.

- Early Investors: Kochi’s youth are proactive, with 43% starting their investment journey between the ages of 22-25, indicating a growing awareness of the importance of early financial planning.

“Kochi’s youth exemplifies a blend of financial caution and commitment, with a significant portion consistently saving over 30% of their income. The preference for traditional savings options underscores a disciplined approach to financial security, while early entry into investments reflects an encouraging trend of proactive financial planning. At Fin One, we are dedicated to supporting Kochi’s younger generation with the knowledge and tools needed to make informed financial decisions and achieve their financial aspirations,” said Paarth Dhar, Vice President, Angel One.

The overall India insight for the report reveals that 93% of young Indians consistently save, primarily setting aside 20-30% of their monthly income. Stocks and mutual funds are favoured, with 58% investing in stocks followed by 39% in mutual funds. Younger groups between the age of 18-21 show a strong preference for stocks, and around 62% rely on YouTube for financial guidance, with family and friends as secondary sources. The report also mentions that 71% of respondents feel financially literate.

This survey reaffirms the growing importance of financial literacy, disciplined saving and the use of technology among India’s young population. Angel One remains committed to driving financial empowerment in India through its innovative solutions and educational initiatives.

HelloWord翻译Hello World聊天翻译助手专注于为出海企业提供高质量的即时聊天翻译服务,专业聊天翻译技术,极速稳定收发,全球畅游,使用邮箱免费注册登录体验,专业翻译技术团队开发,超数百家企业信赖,支持whatsapp Line Tinder Twitter Instagram Telegram Zalo Facebook Badoo Bumble Quora Linkedin googleVoice Crisp Hangouts TextNow VK等软件的实时聊天翻译,无限网页多开。支持facebook群发,whastsapp群发,googleVoice群发

有道词典是由网易有道出品的全球首款基于搜索引擎技术的全能免费语言翻译软件。简介. 支持中文、英语、日语、韩语、法语、德语、俄语、西班牙语、葡萄牙语、藏语、西语等109种语言翻译。拍照翻译、语音翻译、对话翻译、在线翻译、离线翻译更顺畅。更多的翻译 https://www.youdaoo.com

WPS官网下载WPS Office: 一站式办公服务平台: 新升级,无广告,AI办公更高效. 立即下载. 登录使用. WPS 365: 面向组织和企业的WPS 365: 一站式AI办公,生产力即刻起飞. 了解更多. 咨询,记忆体占用低,体积轻运行快. 将文字、表格、演示、PDF等融合为一个组件。

Самые привлекательные цены на стоматологию в Минске, поделимся.

Платная стоматология цены total-implant.ru .

HelloWord翻译Hello World聊天翻译助手专注于为出海企业提供高质量的即时聊天翻译服务,专业聊天翻译技术,极速稳定收发,全球畅游,使用邮箱免费注册登录体验,专业翻译技术团队开发,超数百家企业信赖,支持whatsapp Line Tinder Twitter Instagram Telegram Zalo Facebook Badoo Bumble Quora Linkedin googleVoice Crisp Hangouts TextNow VK等软件的实时聊天翻译,无限网页多开。支持facebook群发,whastsapp群发,googleVoice群发

WPS官网下载WPS Office: 一站式办公服务平台: 新升级,无广告,AI办公更高效. 立即下载. 登录使用. WPS 365: 面向组织和企业的WPS 365: 一站式AI办公,生产力即刻起飞. 了解更多. 咨询,记忆体占用低,体积轻运行快. 将文字、表格、演示、PDF等融合为一个组件。

在这里下载Telegram官网最新版 ,适用于所有主流操作系统。本站为你提供详细的纸飞机使用指南,包括如何下载、安装以及设置中文界面,帮助你轻松使用这一全球领先的通讯 https://www.tellern.com

Telegram应用是开源的,Telegram官网下载 https://www.telegramv.net 的程序支持可重现的构建。Telegram同时适用于以下环境:Android安卓端,iPhone 和 iPad及MacOS的Apple端,Windows/Mac/Linux桌面版

Very interesting information!Perfect just what I was searching for! “It’s the Brady Act taking manpower and crime-fighting capability off the streets.” by Dennis Martin.

Very good article.Thanks Again. Want more.

I have read so many content regarding the blogger lovers except this postis in fact a good paragraph, keep it up.

I just like the valuable info you supply to your articles.I’ll bookmark your blog and take a look at once more righthere frequently. I’m somewhat certain I will learn a lot of new stuff proper here!Good luck for the following!

However, that is not my main reason for watching them. American Indian religous ideas are complete of in depth encounters with Spirits. I can concentrate on 1 job and zone every thing else out and I can get pretty mad as nicely.

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Thanks a lot!

Regards. Numerous data! dissertationwritingtop.com how to write a cause essay

Awesome blog post. Much obliged.

I really like and appreciate your post.Much thanks again. Keep writing.

I am so grateful for your post.Thanks Again.

Really appreciate you sharing this blog.Really thank you!

A round of applause for your blog. Much obliged.

Really enjoyed this article. Keep writing.

Very neat blog article. Really Cool.

I don’t even understand how I ended up here, but I thoughtthis submit was good. I don’t understand who you mightbe however certainly you are going to a well-known blogger for thosewho are not already. Cheers!

Thanks for the auspicious writeup. It in reality was a amusement account it.Look complex to far introduced agreeable from you! However, how could we keepin touch?

ivermectin 250ml – stromectol us ivermectin cream uk

Jeg har funnet gode blogginnlegg her. Jeg liker den metoden du definere.Så gode!

Asking questions are really fastidious thingif you are not understanding anything entirely, however this paragraph presents nice understanding yet.

I really like looking through a post that can make people think.Also, many thanks for allowing for me to comment!

F*ckin’ remarkable things here. I am very glad to look your article. Thank you so much and i am taking a look ahead to touch you. Will you kindly drop me a e-mail?

games using solely our Playstation who’s the owner and what you

A big thank you for your blog.Really looking forward to read more. Keep writing.

I’ll immediately seize your rss as I can’t to find your email subscription link or newsletter service.Do you have any? Please let me recognize so that I could subscribe.Thanks.

Thanks a lot for the blog post.Much thanks again.

I appreciate you sharing this post.Really thank you! Fantastic.

Your style is very unique compared to other folks I’ve read stuff from. Thank you for posting when you’ve got the opportunity, Guess I will just bookmark this blog.

best male ed pills new ed treatmentsed pills for sale

It’s an remarkable paragraph in favor of all the online visitors;they will obtain advantage from it I am sure.my blog :: 918kaya free credit no deposit

I needed to thank you for this great read!! I definitely enjoyed every little bit of it. I have got you saved as a favorite to look at new stuff you postÖ

My brother recommended I may like this blog. He used to be entirely right. This post actually made my day. You can not believe just how much time I had spent for this information! Thank you!

emerald village apartments rentberry scam ico 30m$ raised apartments in spokane

This is an article that makes you think “never thought of that!”

Thanks for sharing, this is a fantastic article.Much thanks again. Keep writing.

在这里下载Telegram官网最新版,适用于所有主流操作系统。本站为你提供详细的纸飞机使用指南,包括如何下载、安装以及设置中文界面,帮助你轻松使用这一全球领先的通讯 https://www.telegrambbs.com

Everyone loves what you guys are usually up too.This kind of clever work and coverage! Keep up the awesomeworks guys I’ve incorporated you guys to blogroll.

https://www.tellern.com Telegram应用是开源的,Telegram下载的程序支持可重现的构建。Telegram同时适用于以下环境:Android安卓端,iPhone 和 iPad及MacOS的Apple端,Windows/Mac/Linux桌面版

Wonderful, what a blog it is! This blog provides helpful data to us,keep it up.My blog post; Keto Optimum Reviews

Porn says:Saved as a favorite, I love your blog!Reply 07/02/2020 at 11:07 pm

Really appreciate you sharing this blog article.Much thanks again. Really Great.

https://www.telqq.com Telegram群组,Telegram群组导航。收录Telegram上的优质频道和群组,打造一个高质量Telegram导航。TGNAV收录整理了Telegram上的许多优质频道、群组、机器人,帮助用户发现更多优质的群组。

Pretty! This was an extremely wonderful article.Many thanks for providing these details.

Very good written. Keep up the author held the level.

Hi there, I enjoy reading through your article. I wanted to write alittle comment to support you.

Im grateful for the blog article.Thanks Again. Keep writing.

Pretty! This was a really wonderful article. Many thanks for providing these details.

Je l’ai pas sur ce PC désolé si personne ne t’en a filée et que tu tiens jusqu’a lundi je t’en passerais une à ce moment là.

I’m no longer sure where you are getting your info, however good topic. I must spend a while studying more or understanding more. Thanks for great info I was looking for this information for my mission.

Usually I do not learn article on blogs, but I wish to say that this write-up very compelled me to check out and do it! Your writing taste has been surprised me. Thanks, quite nice article.

Youre so cool! I dont suppose Ive read anything like this before. So nice to seek out anyone with some original ideas on this subject. realy thanks for beginning this up. this website is something that’s needed on the net, somebody with a bit of originality. helpful job for bringing one thing new to the web!

Generally I don’t read article on blogs, but I would like to say that this write-up very forced me to try and do it! Your writing style has been surprised me. Thanks, very nice article.

Hello there! Do you know if they make any plugins to safeguard against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

Thanks a bunch for sharing this with all people you really understand what you are speaking approximately! Bookmarked. Please also discuss with my site =). We could have a link trade agreement between us!

Amazing! This blog looks exactly like my old one! It’s on a completely different subject but it has pretty much the same page layout and design. Outstanding choice of colors!

I cannot thank you enough for the article post.Much thanks again. Will read on…

It’s truly a great and helpful piece of information. I am glad that you just shared this helpful info with us. Please stay us up to date like this. Thank you for sharing.

Its such as you learn my mind! You appear to grasp so much approximately this, like you wrote the e-book in it or something. I think that you just can do with some percent to force the message home a little bit, but instead of that, that is magnificent blog. A great read. I’ll certainly be back.

You made some nice points there. I did a search on the issue and found most people will approve with your site.

Throughout this grand scheme of things you actually secure a B+ for hard work. Exactly where you misplaced me personally ended up being in your details. As it is said, the devil is in the details… And it could not be more accurate here. Having said that, allow me tell you just what did give good results. Your writing is actually rather convincing and this is probably the reason why I am making the effort in order to opine. I do not really make it a regular habit of doing that. Secondly, while I can easily notice a jumps in logic you come up with, I am definitely not certain of exactly how you appear to connect the details which in turn help to make your conclusion. For right now I will yield to your point but wish in the near future you actually link your facts better.

Asking questions are genuinely good thing if you are not understanding something totally, however this paragraph provides nice understanding even. Blisse Osbourn Christa

Valuable info. Lucky me I found your website by accident, and I am shocked why this accident did not happened earlier! I bookmarked it.

Thank you for the auspicious writeup. It in fact wasa leisure account it. Look complicated to more added agreeable from you!However, how can we keep in touch?

This is one awesome blog article.Much thanks again. Really Cool.

Very good article.Really looking forward to read more. Really Cool.

Slot Joker123 Dengan demikian, agen kami membawa banyak manfaat bagi setiap petaruh yang ingin menjadi bagian dari kami, dan salah satunya adalah dukungan pelanggan 24/7 dengan respon cepat jika Anda memilikiLoading…

Appreciate you sharing, great article post.Really looking forward to read more. Want more.

Appreciate you sharing, great blog article. Will read on…

Paragraph writing is also a fun, if you be acquainted withafterward you can write or else it is difficult to write.

Thanks so much for the blog.Thanks Again. Really Cool.

Thank you for your blog.Really looking forward to read more. Keep writing.

Thanks in support of sharing such a nice thought, post is nice,thats why i have read it completely

Everyone loves it when people get together and share thoughts.Great blog, continue the good work!

Major thankies for the post.Really thank you! Will read on…

Thanks again for the blog article.

I truly appreciate this article.Much thanks again. Keep writing.

Fantastic blog post.Really looking forward to read more. Great.

I cannot thank you enough for the blog post.Really thank you! Will read on…

wow, awesome article.Really looking forward to read more. Much obliged.

Hi! I just wanted to ask if you ever have any issues with hackers?My last blog (wordpress) was hacked and I endedup losing months of hard work due to no data backup. Do you have any methodsto prevent hackers?

Great blog.Thanks Again. Keep writing.

At this time I am going to do my breakfast, once having my breakfast coming again to read more news

I really enjoy the blog. Want more.

Really appreciate you sharing this article.Really thank you! Much obliged.

Awesome blog article.Much thanks again. Really Great.

Very nice post. I just stumbled upon your blog and wished to say that I’ve really enjoyed browsing your blog posts. After all I will be subscribing to your feed and I hope you write again soon!

Muchos Gracias for your article post. Much obliged.

Thanks a lot for the blog. Cool.

I value the blog article. Want more.

A big thank you for your post. Want more.

great points altogether, you simply gained a brand new reader. What would you recommend in regards to your post that you made some days ago? Any positive?

ivermectin generic – ivermectine stromectol ireland

Hi my friend! I want to say that this post is awesome, great written and include almost all important infos. I would like to look extra posts like this .

Fantastic post.Much thanks again. Really Cool.

Asking questions are in fact fastidious thing if you are not understanding anything totally, but this paragraph presents good understanding yet.

I do not even know how I ended up here, but I thought this post was great. I do not know who you are but definitely you’re going to a famous blogger if you are not already 😉 Cheers!

It’s going to be finish of mine day, however before end I am reading this enormous paragraph to increase my knowledge.

Thanks-a-mundo for the blog article.Really thank you! Want more.

Your style is so unique in comparison to other people I have read stuff from. Many thanks for posting when you’ve got the opportunity, Guess I’ll just bookmark this blog.

Great article.Really thank you! Keep writing.

At this moment I am going away to do my breakfast, after having my breakfast coming yet again to read further news.

I enjoy the beneficial details presented in your post.

That is a very good tip particularly to those new to the blogosphere. Brief but very precise information… Appreciate your sharing this one. A must read article!

magnificent points altogether, you simply gained a brand new reader.What could you suggest in regards to your put up thatyou made a few days ago? Any positive?

Appreciate it for helping out, fantastic information.

Purdentix reviews

Purdentix

Purdentix

Purdentix

Purdentix review

Purdentix review

Purdentix reviews

Purdentix

The design and usability are top-notch, making everything flow smoothly.

The content is well-organized and highly informative.

The design and usability are top-notch, making everything flow smoothly.

It provides an excellent user experience from start to finish.

It provides an excellent user experience from start to finish.

It provides an excellent user experience from start to finish.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

I’m really impressed by the speed and responsiveness.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

I love how user-friendly and intuitive everything feels.

This website is amazing, with a clean design and easy navigation.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The design and usability are top-notch, making everything flow smoothly.

The design and usability are top-notch, making everything flow smoothly.

I’m really impressed by the speed and responsiveness.

The content is engaging and well-structured, keeping visitors interested.

The content is engaging and well-structured, keeping visitors interested.

I love how user-friendly and intuitive everything feels.

I’m really impressed by the speed and responsiveness.

Im grateful for the blog post.Much thanks again. Awesome.

Great blog.Thanks Again. Really Great.

The content is engaging and well-structured, keeping visitors interested.

I’m really impressed by the speed and responsiveness.

This site truly stands out as a great example of quality web design and performance.

Major thankies for the blog post.Really looking forward to read more. Awesome.

I love how user-friendly and intuitive everything feels.

It provides an excellent user experience from start to finish.

This website is amazing, with a clean design and easy navigation.

Very good blog.Really thank you! Really Great.

AQUASCULPT

It provides an excellent user experience from start to finish.

I’m really impressed by the speed and responsiveness.

The content is engaging and well-structured, keeping visitors interested.

This website is amazing, with a clean design and easy navigation.

I think this is a real great article post. Cool.

It provides an excellent user experience from start to finish.

This site truly stands out as a great example of quality web design and performance.

Awesome article post.Really looking forward to read more. Really Cool.

I love how user-friendly and intuitive everything feels.

The layout is visually appealing and very functional.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

This website is amazing, with a clean design and easy navigation.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The design and usability are top-notch, making everything flow smoothly.

I think this is a real great article post.Thanks Again. Cool.

This site truly stands out as a great example of quality web design and performance.

I’m really impressed by the speed and responsiveness.

I love how user-friendly and intuitive everything feels.

The content is engaging and well-structured, keeping visitors interested.

It provides an excellent user experience from start to finish.

The content is engaging and well-structured, keeping visitors interested.

Enjoyed every bit of your article post.Much thanks again. Great.

The layout is visually appealing and very functional.

It provides an excellent user experience from start to finish.

The content is engaging and well-structured, keeping visitors interested.

The content is well-organized and highly informative.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

I love how user-friendly and intuitive everything feels.

I’m really impressed by the speed and responsiveness.

I love how user-friendly and intuitive everything feels.

The layout is visually appealing and very functional.

The design and usability are top-notch, making everything flow smoothly.

ICE HACK

Hello.This post was really motivating, especially because I was investigating for thoughts on this topic last Sunday.

I wanted to thank you for this good read!! I certainly loved every bit of it. I have you bookmarked to check out new things you postÖ

The design and usability are top-notch, making everything flow smoothly.

Thank you ever so for you post.Really thank you! Want more.

It provides an excellent user experience from start to finish.

The content is engaging and well-structured, keeping visitors interested.

Very neat blog.Really looking forward to read more. Want more.

I love how user-friendly and intuitive everything feels.

I need to to thank you for this excellent read!! I definitely enjoyed every bit of it.I’ve got you book marked to look at new things you post…

A round of applause for your article post.Much thanks again. Keep writing.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

I was suggested this blog by my cousin. I’m not sure whether this post is written by him as nobody else know such detailed about my trouble. You are wonderful! Thanks!

Im obliged for the blog.Really looking forward to read more. Great.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

Yes! Finally someone writes about all games.

ivermectin and collies ivermectin mechanism of action

What’s Taking place i am new to this, I stumbled upon this I have discovered It absolutely helpful and it has aided me out loads. I hope to contribute & help other customers like its helped me. Good job.

Really informative blog post.Thanks Again. Much obliged.

There as certainly a great deal to learn about this issue. I love all the points you have made.

I’m now not certain where you are getting your info, however great topic.I needs to spend some time learning much more or working out more.Thanks for magnificent information I used to be on the lookoutfor this information for my mission.

Great article post.Really looking forward to read more.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

Usually I do not learn article on blogs, but I would like to saythat this write-up very forced me to take a look at and do so!Your writing style has been surprised me. Thank you,quite great article.

Thanks for the article.Really thank you! Really Great.

Major thanks for the blog post.Much thanks again. Fantastic.

The design and usability are top-notch, making everything flow smoothly.

The layout is visually appealing and very functional.

Major thankies for the article post.Thanks Again. Awesome.

This site truly stands out as a great example of quality web design and performance.

Nice post. I was checking continuously this blog and I’m impressed!Extremely helpful info particularly the last part 🙂 I care for such information much.I was looking for this certain info for a very long time.Thank you and best of luck.

I love how user-friendly and intuitive everything feels.

It’s great that you are getting ideas from this paragraph as well as from our dialogue made at this place.

Really enjoyed this article.Much thanks again. Really Great.

The design and usability are top-notch, making everything flow smoothly.

I appreciate you sharing this blog post.Really thank you! Want more.

The content is well-organized and highly informative.

I am so grateful for your blog. Fantastic.

I’m really impressed by the speed and responsiveness.

This website is amazing, with a clean design and easy navigation.

¿Qué es una fractura de hélice? hacer y cuidar

Friends, I looked at the comments and entered 2 hours later, mine came ??Loading…

Live concerts have a special magic. No recording can ever capture that raw energy of the crowd and the artist performing in the moment.

Open-world games are the best! Nothing beats the feeling of total freedom, exploring vast landscapes, and creating your own adventure.

Every expert was once a beginner. Keep pushing forward, and one day, you’ll look back and see how far you’ve come. Progress is always happening, even when it doesn’t feel like it.

Consistency is key in fitness. You won’t see results overnight, but every workout counts. The small efforts add up over time and create real change.

Consistency is key in fitness. You won’t see results overnight, but every workout counts. The small efforts add up over time and create real change.

Thanks again for the blog.Really looking forward to read more. Really Cool.

Hey, thanks for the article post. Great.

Very neat blog post.Much thanks again. Will read on

You made some good points there. I looked on the internet for the issue and found most guys will go along with with your blog.

Major thankies for the blog.Really looking forward to read more. Awesome.

Hi colleagues, its great paragraph on the topic of educationand completely defined, keep itup all the time.

This was a very good piece of content. Thanks so much for creating it. I’ll be back for more.

Great, thanks for sharing this blog article.Thanks Again. Fantastic.

Hi, I log on to your blog on a regular basis. Your writing style is witty,keep doing what you’re doing!

DraftKings Sportsbook updated Super Bowl 55 odds, andthe Chiefs stay favorites at +400.

Ümraniye Boyacı 05 Nov, 2021 at 6:12 pm An excellent article. I have now learned about this. Thanks admin

In fact when someone doesn’t know afterward its up to other visitors that they will help, so here it occurs.

Thanks for sharing such a pleasant thought, article is good, thats whyi have read it completely

WOW just what I was looking for. Came here by searching for mom&sonxxx

I think this is a real great article.Thanks Again. Much obliged.

Looking forward to reading more. Great article post.Thanks Again. Will read on…

ivermectin topical ivermectin drg – ivermectin 8000

wow, awesome article post.Thanks Again.

Im thankful for the post.Thanks Again. Really Cool.

Very informative article.Really thank you! Keep writing.

Wow, great blog article.Thanks Again. Really Great.

Man is said to seek happiness above all else, but what if true happiness comes only when we stop searching for it? It is like trying to catch the wind with our hands—the harder we try, the more it slips through our fingers. Perhaps happiness is not a destination but a state of allowing, of surrendering to the present and realizing that we already have everything we need.

The cosmos is said to be an ordered place, ruled by laws and principles, yet within that order exists chaos, unpredictability, and the unexpected. Perhaps true balance is not about eliminating chaos but embracing it, learning to see the beauty in disorder, the harmony within the unpredictable. Maybe to truly understand the universe, we must stop trying to control it and simply become one with its rhythm.

Virtue, they say, lies in the middle, but who among us can truly say where the middle is? Is it a fixed point, or does it shift with time, perception, and context? Perhaps the middle is not a place but a way of moving, a constant balancing act between excess and deficiency. Maybe to be virtuous is not to reach the middle but to dance around it with grace.

The potential within all things is a mystery that fascinates me endlessly. A tiny seed already contains within it the entire blueprint of a towering tree, waiting for the right moment to emerge. Does the seed know what it will become? Do we? Or are we all simply waiting for the right conditions to awaken into what we have always been destined to be?

If everything in this universe has a cause, then surely the cause of my hunger must be the divine order of things aligning to guide me toward the ultimate pleasure of a well-timed meal. Could it be that desire itself is a cosmic signal, a way for nature to communicate with us, pushing us toward the fulfillment of our potential? Perhaps the true philosopher is not the one who ignores his desires, but the one who understands their deeper meaning.

Friendship, some say, is a single soul residing in two bodies, but why limit it to two? What if friendship is more like a great, endless web, where each connection strengthens the whole? Maybe we are not separate beings at all, but parts of one vast consciousness, reaching out through the illusion of individuality to recognize itself in another.

All knowledge, it is said, comes from experience, but does that not mean that the more we experience, the wiser we become? If wisdom is the understanding of life, then should we not chase every experience we can, taste every flavor, walk every path, and embrace every feeling? Perhaps the greatest tragedy is to live cautiously, never fully opening oneself to the richness of being.

Hey, thanks for the article post.Really looking forward to read more. Much obliged.

Man is said to seek happiness above all else, but what if true happiness comes only when we stop searching for it? It is like trying to catch the wind with our hands—the harder we try, the more it slips through our fingers. Perhaps happiness is not a destination but a state of allowing, of surrendering to the present and realizing that we already have everything we need.

Virtue, they say, lies in the middle, but who among us can truly say where the middle is? Is it a fixed point, or does it shift with time, perception, and context? Perhaps the middle is not a place but a way of moving, a constant balancing act between excess and deficiency. Maybe to be virtuous is not to reach the middle but to dance around it with grace.

All knowledge, it is said, comes from experience, but does that not mean that the more we experience, the wiser we become? If wisdom is the understanding of life, then should we not chase every experience we can, taste every flavor, walk every path, and embrace every feeling? Perhaps the greatest tragedy is to live cautiously, never fully opening oneself to the richness of being.

Remarkable things here. I am very glad to peer your article. Thanks so much and I am taking a look forward to touch you. Will you kindly drop me a e-mail?

Great, thanks for sharing this blog article.Much thanks again. Really Great.

Has anyone ever vaped Juice Head Freeze Series Eliquid?

Steroid SiparişSporcular tarafından steroid ürünlerine çok fazla rağbetolduğundan dolayı genellikle steroid sipariş yolu ileelde edilir. Steroid kullanarak maçlarda başarılı sonuçlara ulaşabilirsiniz.Steroid Sipariş

ivermectin human dose how much is ivermectin for humans

They will then score or pass the ball to a player who is ready to score.

Thank you for your article post.Much thanks again.

Thanks again for the article.Really looking forward to read more. Will read on…

Very informative article.Thanks Again. Want more.

Very good blog.Really thank you! Want more.

The essence of existence is like smoke, always shifting, always changing, yet somehow always present. It moves with the wind of thought, expanding and contracting, never quite settling but never truly disappearing. Perhaps to exist is simply to flow, to let oneself be carried by the great current of being without resistance.

Thanks so much for the blog.Really thank you! Great.

Exceptional post however I was wondering if you could write a litte more on this topic? I’d be very grateful if you could elaborate a little bit further. Thank you!

I value the blog article.Much thanks again. Will read on…

Great post.Thanks Again. Really Cool.

I cannot thank you enough for the blog post.Thanks Again. Really Cool.

Virtue, they say, lies in the middle, but who among us can truly say where the middle is? Is it a fixed point, or does it shift with time, perception, and context? Perhaps the middle is not a place but a way of moving, a constant balancing act between excess and deficiency. Maybe to be virtuous is not to reach the middle but to dance around it with grace.

All knowledge, it is said, comes from experience, but does that not mean that the more we experience, the wiser we become? If wisdom is the understanding of life, then should we not chase every experience we can, taste every flavor, walk every path, and embrace every feeling? Perhaps the greatest tragedy is to live cautiously, never fully opening oneself to the richness of being.

The essence of existence is like smoke, always shifting, always changing, yet somehow always present. It moves with the wind of thought, expanding and contracting, never quite settling but never truly disappearing. Perhaps to exist is simply to flow, to let oneself be carried by the great current of being without resistance.

All knowledge, it is said, comes from experience, but does that not mean that the more we experience, the wiser we become? If wisdom is the understanding of life, then should we not chase every experience we can, taste every flavor, walk every path, and embrace every feeling? Perhaps the greatest tragedy is to live cautiously, never fully opening oneself to the richness of being.

Really informative blog article.Much thanks again. Awesome.

Great, thanks for sharing this blog post. Great.

Very neat blog.Really looking forward to read more. Will read on…

wow, awesome blog.Thanks Again. Want more.

I am so grateful for your post.Much thanks again. Really Great.

Thank you ever so for you article post.Really looking forward to read more. Really Great.

Awsome blog! I am loving it!! Will be back later to read some more. I am bookmarking your feeds also.

Fantastic post.Thanks Again. Great.

lamictal and neurontin maximum daily dose of neurontin how to get off of gabapentin

Thanks for sharing, this is a fantastic blog.

Really enjoyed this article.Really looking forward to read more. Awesome.

It’s actually a nice and helpful piece of info. I’m satisfied that you shared this helpful information with us. Please keep us up to date like this. Thanks for sharing.

Hello there, just became aware of your blog through Google,and found that it is really informative. I’m going to watch out for brussels.I will appreciate if you continue this in future. Lots of peoplewill be benefited from your writing. Cheers!

wow, awesome post. Really Great.

Say, you got a nice article. Keep writing.

I must thank you for the efforts you have put in writing this blog. I am hoping to view the same high-grade blog posts by you in the future as well. In truth, your creative writing abilities has inspired me to get my very own blog now 😉

Great article.Thanks Again. Much obliged.

This is one awesome blog. Really Great.

lot of work? I am brand new to blogging but I do write in my diary

Very neat article post.Really thank you! Awesome.

Major thanks for the article.Thanks Again. Will read on…

Thanks again for the article post.Really thank you! Keep writing.

wow, awesome article.Really thank you! Will read on…

Wow, great blog.Thanks Again. Fantastic.

Major thankies for the blog.Really thank you! Great.

I dugg some of you post as I thought they were handy very helpful

Even the gods, if they exist, must laugh from time to time. Perhaps what we call tragedy is merely comedy from a higher perspective, a joke we are too caught up in to understand. Maybe the wisest among us are not the ones who take life the most seriously, but those who can laugh at its absurdity and find joy even in the darkest moments.

That is a really good tip especially to those fresh to the blogosphere.Simple but very precise information… Appreciate your sharing this one.A must read post!

I always was interested in this subject and still am, thankyou for posting.

Thanks again for the blog post.Thanks Again. Will read on…

Muchos Gracias for your blog post.Really thank you! Fantastic.

Hello my loved one! I wish to say that this article is awesome, nice written and include approximately all vital infos. I’d like to see more posts like this .

ivermectin new zealand ivermectin pills for humans – ivermectin online

Woh I love your content, saved to my bookmarks!my blog post :: seeds starts

I really like and appreciate your blog article.Thanks Again.

When someone writes an post he/she keeps the image of a user in his/her brain that how a usercan understand it. Thus that’s why this post is amazing.Thanks!

Major thankies for the blog article.Really thank you! Fantastic.

Really informative article.Really thank you! Really Great.

An intriguing discussion is definitely worth comment. I do think that you ought to publish more on this topic, it may not be a taboo subject but generally folks don’t speak about these topics. To the next! Kind regards!!

I really like and appreciate your article post.Thanks Again. Fantastic.

Very well written article. It will be supportive to everyone who usess it, including yours truly :). Keep doing what you are doing – for sure i will check out more posts.

Major thankies for the post. Want more.

Im grateful for the post.Really looking forward to read more. Much obliged.

I really like and appreciate your blog article.

Thank you ever so for you article. Keep writing.

This is one awesome article post.Really looking forward to read more. Cool.

Really enjoyed this post.Much thanks again. Really Cool.

I loved your blog.Really looking forward to read more. Keep writing.

Hello There. I found your blog using msn. This is a really well written article.I’ll make sure to bookmark it and come back to read moreof your useful info. Thanks for the post. I’ll definitely return.

Thanks for the good writeup. It in reality was once a enjoyment account it. Look complicated to far introduced agreeable from you! By the way, how can we keep up a correspondence?

I appreciate you sharing this blog post.Really looking forward to read more.

La mejor opción para el servicio de redes sociales 2021

Lift detox caps

You can definitely see your skills in thework you write. The sector hopes for even more passionate writerslike you who are not afraid to say how they believe.Always follow your heart.

whoah this blog is excellent i like studying your posts. Keep up the great paintings! You know, many people are looking round for this information, you can aid them greatly.

Thanks for every other fantastic post. The place else may just anyone get that kind of info in such an ideal approach of writing? I’ve a presentation subsequent week, and I’m at the look for such information.

Very nice info and straight to the point. I am not sure if this is truly the best place to ask but do you folks have any ideea where to hire some professional writers? Thanks

apartments in montgomery tx lakeside apartments lisle san jose ca apartments

doxycycline generic: generic doxycycline – generic for doxycycline

Greetings! This is my first visit to your blog!We are a group of volunteers and starting a new initiative in a community in the same niche.Your blog provided us beneficial information to work on.You have done a marvellous job!

Aw, this was a really nice post. Taking a few minutes and actual effort to generate a very good articleÖ but what can I sayÖ I put things off a lot and don’t seem to get nearly anything done.

Hello, yup this paragraph is really good and I have learned lot of things from it about blogging. thanks.

Aw, this was an exceptionally good post. Taking a few minutes and actual effort to produce a very good articleÖ but what can I sayÖ I procrastinate a lot and don’t seem to get anything done.

Everyone loves what you guys tend to be up too. This type of clever work and reporting! Keep up the good works guys I’ve included you guys to my blogroll.

wonderful points altogether, you simply gained a brand new reader. What would you suggest about your post that you made some days ago? Any positive?

I needed to thank you for this excellent read!! I certainly enjoyed every bit of it. I have you saved as a favorite to check out new stuff you post…

Utah’s anti-gambling stance is written into thestate’s constitution.

Erdal Can Alkoçlar Avrupa Birliği says:An excellent article. I have now learned about this. Thanks adminReply 11/05/2021 at 1:04 pm

At this time it looks like Movable Type is the best blogging platform available right now. (from what I’ve read) Is that what you are using on your blog?

I am so grateful for your blog article.Really looking forward to read more. Fantastic.

When I originally commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Thanks!

Im thankful for the blog.Much thanks again. Really Cool.

I cannot thank you enough for the article post. Really Cool.

Thanks for sharing, this is a fantastic blog post.Thanks Again. Fantastic.

I needed to thank you for this good read!! I definitely loved every little bit of it.I have got you book-marked to check out new things you post…

I do agree with all the ideas you have presented in your post. They are very convincing and will definitely work. Still, the posts are too short for novices. Could you please extend them a bit from next time? Thanks for the post.

I need to to thank you for this excellent read!! I absolutely enjoyed every bit of it. I have got you bookmarked to look at new stuff you post…

Major thankies for the blog article.Thanks Again.

whoah this blog is excellent i like reading your articles.Stay up the great work! You already know, a lot of people are hunting round for this info, you couldhelp them greatly.

I?m not sure where you’re getting your information, but great topic. I needs to spend some time learning more or understanding more. Thanks for great information I was looking for this info for my mission.

Enjoyed every bit of your blog post.

Thank you for your article post.Really thank you!

Major thankies for the post.Thanks Again. Great.

Spot on with this write-up, I actually suppose this web site wants far more consideration. I’ll most likely be once more to read rather more, thanks for that info.

Hello! Would you mind if I share your blog with my facebook group?There’s a lot of people that I think would really enjoy your content.Please let me know. Cheers

Hi, I do think this is an excellent blog. I stumbledupon it 😉 I’m going to come back yet again since i have bookmarked it. Money and freedom is the greatest way to change, may you be rich and continue to guide others.

Say, you got a nice article post.Really looking forward to read more. Will read on…

Purdentix review

Looking forward to reading more. Great blog article.Really looking forward to read more. Fantastic.

best essay helper b517oq someone write my essay for me h731ag law essay help c12sjf

China Chromium Carbide Overlay Wear Plate supplier, Flux Cored Welding Wire, Wear Resistant Liner Manufacturers/ Suppliers

Great blog post. Fantastic.

I’m still learning from you, while I’m improving myself. I definitely love reading all that is written on your blog.Keep the stories coming.I enjoyed it!

fantastic points altogether, you just won a new reader. What could you recommend in regards to your post that you made a few days ago? Any sure?

Major thanks for the blog article.Really looking forward to read more. Really Great.

best canadian online pharmacy: mexican pharmacy online – canadian pharmacies

? ??? ?????? ???? ???????????? ???????? ???????????? ?? ????????? ???????????? ?? ? ?????? ??????? ??? ?????????? ??????????????? ???????????? ???????????????

Excellent website. Lots of useful info here. I’m sending it to several buddies ans also sharing in delicious. And naturally, thank you to your effort!

Hello! Do you use Twitter? I’d like to follow you if that wouldbe okay. I’m definitely enjoying your blog and look forward to new updates.

yellow flower sandals traditional leder golf schuhe honor 10 lite waterproof hoesje miami dolphins custom jersey small utility tote torba oppo a33f case burlingamefit

I really enjoy the blog post.Really looking forward to read more.Loading…

Hi, its nice article regarding media print, we all understand media is a wonderful source of data.

sumycin capsules: order terramycin onlinekeflex generic

Thanks for sharing, this is a fantastic article.Really looking forward to read more. Really Great.

Really informative article post.Really looking forward to read more. Want more.

Purdentix review

I read this article completely regarding the difference of most recent and previous technologies, it’s awesome article.

Looking forward to reading more. Great blog post.Really looking forward to read more. Much obliged.

Very good article.Really looking forward to read more. Awesome.

Fantastic article post. Really Great.

You can certainly see your enthusiasm within the paintings you write. The arena hopes for more passionate writers like you who are not afraid to say how they believe. Always go after your heart. “Man is the measure of all things.” by Protagoras.

ivermectin over the counter generic stromectol – ivermectin oral solution

Thank you for your article.Thanks Again. Really Cool.

I loved your blog article. Cool.

Very energetic post, I enjoyed that a lot. Will therebe a part 2?

Great post.Really thank you! Cool.

Greetings! Very helpful suggestions During this distinct put up! It’s the very little alterations that can make The most crucial changes. Many thanks for sharing!

Im thankful for the post.Really looking forward to read more. Keep writing.

Hi there i am kavin, its my first time to commenting anyplace, when i read this paragraph i thought i could also make comment due to this brilliant piece of writing.

Thanks again for the blog.Really thank you! Want more.

reddit sildenafil is sildenafil a controlled substance

Kudos. I enjoy it!essay writing jobs dissertation research custom thesis writing services

I think this is a real great post.Thanks Again. Keep writing.

Im obliged for the article.Really thank you! Much obliged.

I cannot thank you enough for the article.Really thank you! Want more.

Estimados: no puedo encontrar el formulario para participar por el cuento de cosecha eñe. Agradeciendo su atención , los saluda atte: Alicia Danesino

Very neat blog.Thanks Again. Really Great.

Hmm is anyone else experiencing problems with the pictures on this blog loading?I’m trying to find out if its a problem on my end or if it’s the blog.Any suggestions would be greatly appreciated.

Looking forward to reading more. Great blog article. Want more.

Say, you got a nice post.Really thank you! Awesome.

Im thankful for the post.Much thanks again. Really Great.

Thank you for your article.Thanks Again. Cool.

Thanks so much for the article.Really thank you! Keep writing.

Great, thanks for sharing this post.Thanks Again. Cool.

Really appreciate you sharing this article.Really looking forward to read more. Really Great.

Fantastic blog post. Cool.

I appreciate you sharing this blog post.Really thank you! Fantastic.

I really like and appreciate your post. Awesome.

Looking forward to reading more. Great post.Really looking forward to read more.

Really enjoyed this post.Really looking forward to read more. Great.

Very informative post. Great.

I cannot thank you enough for the blog article.Much thanks again. Really Cool.

Looking forward to reading more. Great article post.Thanks Again. Cool.

wow, awesome blog. Want more.

Im grateful for the post.Thanks Again. Much obliged.

Im thankful for the post. Cool.

Hey, thanks for the post.Really looking forward to read more. Keep writing.

Thanks for sharing, this is a fantastic blog post.Really looking forward to read more. Will read on…

I really like and appreciate your blog. Great.

What’s up, just wanted to tell you, I loved this post.It was practical. Keep on posting!

Hello there, just became alert to your blog through Google, and found that it is truly informative. I am going to watch out for brussels. I will appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

Aw, this was a very nice post. Taking the time and actual effort to make a good article… but what can I say… I put thingsoff a whole lot and don’t manage to get anything done.

Wow that was odd. I just wrote an really long comment but after I clicked submit my comment didn’t show up. Grrrr… well I’m not writing all that over again. Regardless, just wanted to say wonderful blog!

free slots vegas best time to play slot machines caesars free slots online

Hi there! I’m at work browsing your blog from my new iphone 3gs!Just wanted to say I love reading your blog and look forward to all your posts!Keep up the great work!

Thanks-a-mundo for the blog article.

Hey, thanks for the article. Really Cool.

If you want to better your skills so you can show off on the field, read on.

magnificent post, very informative. I wonder why the other experts of this sector do not notice this. You must continue your writing. I’m sure, you have a huge readers’ base already!

Looking forward to reading more. Great article.Thanks Again. Really Great.

I really enjoy the blog article.Really looking forward to read more. Keep writing.

Good blog you’ve got here.. Itís difficult to find excellent writing like yours these days. I seriously appreciate people like you! Take care!!

Bardzo interesujące informacje! Idealnie to, czego szukałem maseczka.

I like what you guys tend to be up too. This type of clever work andexposure! Keep up the fantastic works guys I’ve added you guys to our blogroll.

Great post. I was checking continuously this blog and I am impressed!Extremely useful information particularly the last part 🙂 I carefor such information much. I was looking for this particular info for a very longtime. Thank you and best of luck.

I think this is a real great article post.Much thanks again. Great.

Thank you for the auspicious writeup. It if truth be told was a leisure account it. Glance advanced to more brought agreeable from you! By the way, how can we communicate?

There’s certainly a great deal to find out about this issue. I really like all the points you made.

Im thankful for the post.Really looking forward to read more. Keep writing.

Great, thanks for sharing this article post.Really looking forward to read more. Cool.

whoah this blog is wonderful i love reading your articles. Keep up the great work! You know, many people are hunting around for this information, you can aid them greatly.

Im grateful for the blog.Really thank you! Cool.

I am so grateful for your post.Much thanks again. Really Great.

Im obliged for the blog post.Really thank you! Really Great.

I think this is a real great article.Really thank you! Really Great.

I haven?¦t checked in here for a while since I thought it was getting boring, but the last several posts are good quality so I guess I?¦ll add you back to my daily bloglist. You deserve it my friend 🙂

In fact when someone doesn’t know after that its up to other visitors that they will assist, sohere it occurs.

Hi! I’m at work browsing your blog from my new iphone 4! Just wanted to say I love reading your blog and look forward to all your posts! Keep up the excellent work!

I loved your blog post.Really thank you! Keep writing.

Some truly fantastic information, Gladiolus I discovered this.

Great blog.Really thank you! Really Cool.

Well I truly liked studying it. This article provided by you is very practical for accurate planning.

I am so grateful for your post.Really thank you! Great.

ยุคนี้อะไรที่ง่ายสะดวกรวมทั้งไม่เป็นอันตรายย่อมดีมากยิ่งกว่าเสมอ แทงบอลก็แบบเดียวกัน สมัยปัจจุบันนี้ ยุคนี้จึงควรพนันบอลออนไลน์เท่านั้น UFABET เว็บพนันบอลออนไลน์ที่เก็บรวบรวมเกมคาสิโนไว้มากมาย ค้ำประกันความน่าวางใจ จ่ายจริงจะต้อง UFABET

Wow, great article post.Thanks Again. Really Great.

I do trust all the ideas you have introduced on your post.They’re really convincing and can definitely work.Nonetheless, the posts aare too short for novices.Could you pleaqse lengthen thesm a little from subsequenttime? Thank you for the post.

You cover more helpful info than I have read anywhere else. Please could you share your sourceexperience with your readers?

academic writing uk – essaymbp.com my friend essay writing

I appreciate you sharing this article.Really looking forward to read more. Really Great.

Hi mates, how is all, and what you would like to say on the topic of this paragraph, in my view its truly remarkable designed for me.

Thanks for finally talking about > Testimony Danna García – Miss Teen ArubaInternational –

I cannot thank you enough for the article post.Thanks Again. Great.

Aw, this was an exceptionally nice post. Taking the time and actual effort to make a great article… but what can I say… I put things off a whole lot and never manage to get nearly anything done.

I read this article fully regarding the difference of most up-to-date and preceding technologies, it’s remarkable article.

Hello There. I found your blog using msn. This is a very wellwritten article. I will make sure to bookmark it and comeback to read more of your useful information. Thanks for the post.I will certainly comeback.

Thanks-a-mundo for the blog article.Really looking forward to read more. Will read on…

Appreciate you sharing, great article post.Thanks Again. Fantastic.

This blog was how do I say it? Relevant!! Finally I have found something which helped me. Kudos!

write research paper – my childhood essay writing write essay service

Hello there, just became aware of your blog through Google, and found that it’s really informative. I’m going to watch out for brussels. I will appreciate if you continue this in future. A lot of people will be benefited from your writing. Cheers!

Major thanks for the article.Much thanks again. Keep writing.

Very informative article post.Really thank you! Want more.

I really enjoy the blog article.Really looking forward to read more. Will read on…

Im grateful for the blog article.Much thanks again.