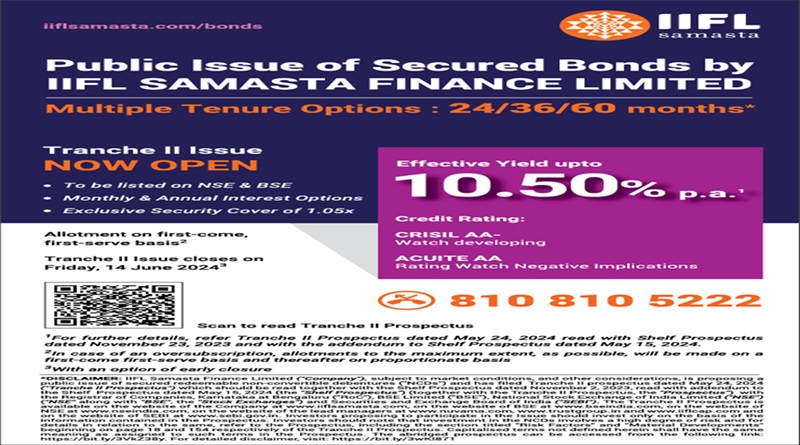

IIFL Samasta Raises Funds: Up to Rs. 1,000 Crores with 10.5% Potential Return

Gurgaon: IIFL Samasta Finance, which is one of India’s largest non-banking microfinance companies (NBFC-MFI), will raise up to Rs 1,000 crores through public issue of secured bonds, for the purpose of capital augmentation and business growth. The bonds offer up to 10.50% and high degree of safety. The issue opens on Monday, June 3, 2024 and closes on Friday, June 14, 2024.

IIFL Samasta Finance will issue bonds, aggregating to Rs 200 crore, with a green-shoe option to retain over-subscription of up to Rs 800 crore (aggregating to a total of Rs 1,000 crore). The IIFL Samasta bonds offer highest coupon rate of 10.50% per annum for tenor of 60 months. The NCD is available in tenors of 24 months, 36 months and 60 months. The frequency of interest payment is available on monthly and annual basis for each of the series.

The credit rating is “CRISIL AA-/Watch Developing” by CRISIL Ratings Limited and “Acuite AA| Rating Watch Negative Implication” by Acuite Ratings and Research Limited.

IIFL Samasta Finance’s MD and CEO Mr. Venkatesh N said, “IIFL Samasta Finance has a strong physical presence of across India through about 1,500 branches. It caters to the credit needs of underserved and unserved population, primarily women entrepreneurs from underprivileged background through a well-diversified portfolio. The funds raised will be used to meet credit demand from more such customers and bolster business growth.”

IIFL Samasta Finance offers innovative and affordable financial products to women who are enrolled as members and organized as Joint Liability Group from unbanked sections in society including encompassing cultivators, agricultural laborers, vegetable and flower vendors, cloth traders, tailors, craftsmen, as well as household and industrial workers across rural, semi urban and urban areas in India.

IIFL Samasta Finance also reported record net profit of Rs 503.05 crore for the financial year 2023-2024, while loan assets under management rose 34.67% year-on-year to a record Rs 14,211.28 crore. IIFL Samasta Finance’s customer count has increased from 23.54 lakh customers as of March 31, 2023 to 30,01 lakh customers as of March 31, 2024, mostly women in smaller rural and semi-urban locations across India. IIFL Samasta Finance, which is a subsidiary of retail-focused non-banking financial company, IIFL Finance Limited, has been one of the fastest growing and most resilient microfinance institutions in India.

IIFL Samasta Finance has consistently maintained low level of NPAs over the years of operations and continues to focus on good quality assets. IIFL Samasta Finance’s net non-performing assets (NPA) stood at 0.34% at the end of FY24, while gross NPA was at 1.91%. The company’s net worth rose 51% year-on-year to Rs 1,919.99 crore. IIFL Samasta Finance has a widespread network of 1,648 branches spanning the length and breadth of the country and has a strong workforce of 16,519 employees (including trainees)

In April 2024, former Chairman of NABARD, Dr. Govinda Rajulu Chintala joined IIFL Samasta as Chairman of the board. Former Managing Director of Equifax Credit Information Services Mr. Kalengada Mandanna Nanaiah and Co-promoter of IIFL Group, Mr. R. Venkataraman have also joined the board. Mr Venkataraman joined as Additional Director(non-executive), while Dr. Chintala and Mr. Nanaiah joined as Additional Director (non-executive and Independent). The Board will now comprise of six members.

The lead managers to the issue are Trust Investment Advisors Private Limited, Nuvama Wealth Management Limited and IIFL Securities Limited. The NCDs will be listed on the BSE Limited and National Stock Exchange of India Limited (NSE), to provide liquidity to the investors. The NCDs would be issued at face value of Rs 1,000 and the minimum application size is Rs 10,000 across all categories. The public issue opens on Monday, June 3, 2024 and closes on Friday, June 14, 2024, with an option of early closure. The allotment will be made on first come first served basis.

Very interesting information!Perfect just what I was searching for! “I have a hundred times wished that one could resign life as an officer resigns a commission.” by Robert Burns.

Excellent web site. Plenty of useful info here. I am sending it to several friends ans also sharing in delicious. And naturally, thanks for your effort!

Appreciate it for helping out, superb information.

Definitely believe that which you stated. Your favorite reason appeared to be on the net the simplest thing to be aware of. I say to you, I definitely get irked while people think about worries that they plainly do not know about. You managed to hit the nail upon the top and defined out the whole thing without having side effect , people can take a signal. Will probably be back to get more. Thanks

Heya i am for the primary time here. I found this board and I in finding It really helpful & it helped me out much. I’m hoping to provide one thing again and aid others such as you helped me.

Very nice post. I just stumbled upon your weblog and wished to say that I have really enjoyed surfing around your blog posts. In any case I will be subscribing to your feed and I hope you write again soon!

897537 216142I truly appreciated this fantastic blog. Make positive you keep up the great work. All the very best !!!! 117792

Hi, i think that i saw you visited my weblog so i came to “return the favor”.I am trying to find things to enhance my website!I suppose its ok to use a few of your ideas!!

I’ve been absent for some time, but now I remember why I used to love this site. Thank you, I will try and check back more often. How frequently you update your website?

I think this is one of the most vital information for me. And i am glad reading your article. But wanna remark on few general things, The web site style is perfect, the articles is really excellent : D. Good job, cheers

344899 974174i was just browsing along and came upon your weblog. just wantd to say fantastic website and this post actually helped me. 257050

452193 633496You got a extremely good internet site, Gladiola I discovered it via yahoo. 63031

Attractive component of content. I simply stumbled upon your website and in accession capital to claim that I acquire in fact loved account your weblog posts. Anyway I will be subscribing for your augment and even I success you get admission to constantly fast.

257410 535426Hey. Neat post. There can be a problem with your internet site in firefox, and you may want to check this The browser will be the market chief and a large component of other folks will omit your excellent writing because of this dilemma. 581281

I must express my thanks to you just for rescuing me from this type of scenario. Right after surfing around through the search engines and meeting principles that were not beneficial, I figured my life was well over. Being alive minus the answers to the issues you’ve sorted out through your entire guide is a critical case, as well as ones that might have in a wrong way affected my entire career if I had not discovered your web site. Your actual capability and kindness in maneuvering all the stuff was excellent. I am not sure what I would have done if I hadn’t encountered such a subject like this. I can at this moment look ahead to my future. Thanks for your time so much for the professional and sensible guide. I won’t be reluctant to recommend the sites to anybody who should receive guidance on this subject matter.

You have mentioned very interesting points! ps nice website . “The world is dying for want, not of good preaching, but of good hearing.” by George Dana Boardman.

I’ve been absent for a while, but now I remember why I used to love this website. Thanks , I’ll try and check back more frequently. How frequently you update your website?

Die Preise können Freispiele, Geld oder andere Dinge sein. Wenn Freispiele eher Ihr Ding

sind, können Sie aber auch den Code SATFS anwenden.

Mit dem Code SATBONUS erhalten Sie bei einer Mindesteinzahlung von 20€

nämlich 50% bis 100€ auf Ihre Einzahlung.

Jeder neue Spieler im Lucky7even Casino wird mit einem fantastischen Willkommensbonus begrüßt, der sowohl Match-Boni

als auch Freispiele beinhaltet. Unsere großzügigen Willkommensboni,

Treueprämien und exklusiven Aktionen sorgen dafür,

dass Sie bei jedem Besuch das Beste herausholen. Mit Echtzeit-Dealern und einer sozialen Atmosphäre spielen Sie traditionelle Spiele wie Blackjack, Baccarat und Roulette mit einem echten Dealer ganz bequem von zu Hause aus.

Für Spieler, die strategieorientierte Spiele bevorzugen, bieten wir

eine große Auswahl an Tischspielen wie Blackjack, Roulette, Baccarat

und Poker.

References:

https://online-spielhallen.de/hitnspin-casino-test-bonus-spiele/

Welche Umsatzbedingungen gelten für den SpinRollz Willkommensbonus?

Jedoch bietet das Joker8 Casino weitaus mehr Reload Bonusangebote, die du dir unter der Woche sichern kannst.

Ob Sportwetten Bonus oder zwei unterschiedliche Neukundenboni

– im Joker8 Casino kannst du dir selbst dein favorisiertes Bonusangebot aussuchen und

dir somit ein Bonusguthaben von bis zu 1.000€ sichern.

Die Lizenzangaben findet man übrigens im Footer, aber erst nach ausklappen des Menüs.

Täglich lockt auch eine Runde mit der Bonus Krabbe bei einer Mindesteinzahlung

von 10€. Wenn nicht anders angegeben, gelten dieselben Bonusbedingungen wie beim Willkommensbonus.

References:

https://online-spielhallen.de/venlo-casino-cashback-so-holen-sie-sich-ihr-geld-zuruck/

Chicken thighs and sweet potato get crispy in the oven while broccolini roasts alongside

in a foil packet for even cooking and easy cleanup.

You can trim a regular chicken breast down to the right size, or cut a large 8-ounce breast in half crosswise to get two smaller pieces.

Ready in just 20 minutes, this soup is the perfect remedy for a cold, offering comfort

and relief with minimal effort. The combination of tender chicken breast, ginger and garlic boosts flavor,

while the warm broth helps clear congestion and keep you hydrated.

If you don’t have chicken cutlets on hand, you can easily make your own by slicing two 8-ounce chicken breasts in half horizontally.

With tender, juicy chicken and crisp, fresh broccoli as

the base, this salad delivers a satisfying bite in every forkful.

The Okada Manila Entertainment Group (OMEG) brings world-class performances to life,

enriching the vibrant entertainment landscape.

Culinary delights await at over 40 dining venues, and a variety

of shopping options ensure convenience and luxury at your fingertips.

For families, PLAY and Thrillscape provide exciting and engaging entertainment options designed to cater to both developmental and recreational

needs.

It’s the perfect place to celebrate, unwind, or simply enjoy Metro

Manila’s upscale party scene. Whether you want to dance the night away, sip cocktails poolside, or catch a

live DJ set, Cove Manila delivers a one-of-a-kind party atmosphere

you won’t find anywhere else in the city. This state-of-the-art venue hosts world-class concerts,

themed parties, and unforgettable nightlife experiences under one massive glass dome.

References:

https://blackcoin.co/this-is-vegas-casino-review/

As of 2020, results of surveys commissioned by the Competition and Markets Authority showed it continued

to be the most recommended UK bank. By 2004, First Direct had established a position as the United Kingdom’s most recommended bank.

The bank also announced it would brand the new

arm, including all of its branches, as HSBC UK. Branches also feature HSBC Live,

a radio station specifically produced for the bank by media company Immedia in Newbury,

Berkshire.

As part of a regulatory requirement, an independent survey was conducted to ask

approximately 500 customers of each of the 12 largest current account providers if they would recommend their provider to friends and

family. Platform for tech innovations, business, insights Pakistan, and

practical solutions tailored to Pakistan’s unique needs.

As Atif Aslam evolves with each new song and appearance, his legacy

as a music icon and style maven remains strong,

leaving an indelible mark on the world stage. Beyond music, his influence extends to

fashion, where his style choices set trends and reflect his cultural roots.

Atif Aslam’s distinctive style, coupled with his global appeal and fashion collaborations, continues

to inspire fans and shape trends in the fashion industry, showcasing his enduring influence beyond music.

Subject to application, eligibility, credit check

and T&Cs. Your eligible deposits with HSBC UK Bank plc are protected up to

a total of £120,000, or up to £240,000 for joint accounts, by the

Financial Services Compensation Scheme, the UK’s deposit guarantee scheme.

For example, for every £1 million received

into consumer accounts at HSBC UK and first direct, £128 of it was APP scams.

For example, for every £1 million received into consumer

accounts at Skrill, £18,550 of it was APP scams. This is the amount of money sent from the victim’s account to the scammer, ranked out of 14 firms.

You can read the full report by visiting /app-fraud-data

References:

https://blackcoin.co/why-a-players-position-in-poker-is-important/

online casino uk paypal

References:

hootic.com

paypal online casinos

References:

04civil.com

I’d constantly want to be update on new posts on this web site, saved to bookmarks! .

Hello, you used to write great, but the last few posts have been kinda boring… I miss your great writings. Past few posts are just a bit out of track! come on!

I’d constantly want to be update on new blog posts on this internet site, saved to fav! .