Google Unveils 3 New Game-Changing Features for Google Pay: UPI Circle, Vouchers & More

In brief:

New Delhi: Google Pay, one of India’s most popular payment apps, has introduced several new features aimed at enhancing user experience. Announced at the Global Fintech Fest 2024, these features include UPI Circle, UPI Vouchers, Clickpay QR, and more. These updates are expected to roll out later this year, making digital payments even more seamless and accessible.

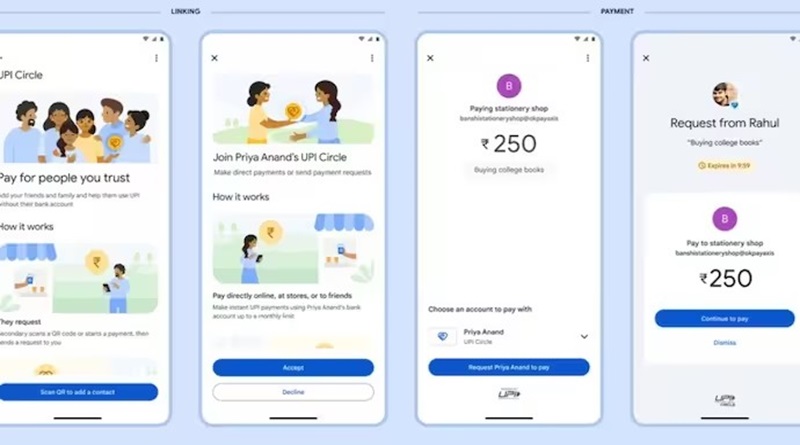

UPI Circle

A standout feature is UPI Circle, designed to help users delegate payment responsibilities to trusted individuals like family members or friends. This is particularly useful for those who don’t have direct access to banking services or are hesitant about using UPI. UPI Circle allows an existing Google Pay user to add secondary users to their account with two levels of delegation:

- Partial Delegation: The primary user must approve each payment request initiated by the secondary user.

- Full Delegation: The primary user can set a monthly limit (up to Rs 15,000), allowing the secondary user to make payments independently within that limit.

UPI Vouchers

Google Pay is expanding UPI Vouchers, originally introduced for COVID-19 vaccination payments. Now, these prepaid vouchers can be linked to a recipient’s mobile number and used across various sectors. UPI Vouchers simplify transactions by eliminating the need for the recipient to link a bank account to UPI, making it easier for organizations and individuals to issue and utilize vouchers.

Clickpay QR

Clickpay QR is a new feature designed to make bill payments more convenient. In partnership with NPCI Bharat Billpay, this feature allows users to scan a Clickpay QR code with the Google Pay app. The QR code fetches the latest bill details automatically, removing the need to remember account numbers or customer IDs, ensuring a fast and hassle-free bill payment experience.

Prepaid Utilities Payment

Google Pay is also expanding support for recurring payments with Prepaid Utilities Payment. Users can now link and manage their prepaid utility accounts, such as electricity or housing society bills, directly within the app. This feature centralizes and simplifies the management of recurring payments.

Tap & Pay with RuPay Cards

Google Pay is introducing Tap & Pay for RuPay cards, allowing users to add their RuPay cards to the app and make payments by tapping their mobile phone at a card machine. This feature ensures that card details are securely stored, making payments more convenient and reducing the need to carry physical cards.

Autopay for UPI Lite

Finally, Autopay for UPI Lite is a new feature that automatically tops up a user’s UPI Lite balance when it falls below a certain threshold. UPI Lite, designed for small-ticket transactions, ensures users can continue making payments without worrying about insufficient balance.

These updates reflect Google Pay‘s commitment to making digital payments in India more accessible, user-friendly, and inclusive, paving the way for a more convenient financial ecosystem.

FOLLOW FOR MORE .

Pingback: UPI Circle 2024 Empowers Trusted Family Members to Seamlessly Make Payments for You - fnnnews

Thank you, I’ve recently been searching for information about this topic for ages and yours is the best I’ve came upon so far. However, what about the conclusion? Are you sure in regards to the supply?

It’s hard to find knowledgeable people on this topic, but you sound like you know what you’re talking about! Thanks

зайти на сайт [url=https://vodkabetslot.ru]водка бет сайт[/url]

It’s a pity you don’t have a donate button! I’d most certainly donate to this fantastic blog! I guess for now i’ll settle for bookmarking and adding your RSS feed to my Google account. I look forward to new updates and will talk about this website with my Facebook group. Chat soon!

I have learn some excellent stuff here. Definitely worth bookmarking for revisiting. I wonder how much effort you place to make this type of wonderful informative website.

Thank you for any other informative web site. Where else could I am getting that type of info written in such a perfect way? I have a project that I am just now operating on, and I have been on the glance out for such information.

Hello, i think that i saw you visited my blog thus i came to “return the favor”.I am attempting to find things to improve my website!I suppose its ok to use a few of your ideas!!

hello there and thanks to your information – I’ve certainly picked up something new from right here. I did however expertise some technical points the use of this website, as I skilled to reload the site lots of occasions previous to I may just get it to load properly. I had been brooding about in case your hosting is OK? Not that I am complaining, but slow loading cases instances will sometimes have an effect on your placement in google and could damage your high quality rating if advertising and ***********|advertising|advertising|advertising and *********** with Adwords. Anyway I am adding this RSS to my email and can look out for much extra of your respective exciting content. Ensure that you replace this again soon..

It’s really a great and useful piece of info. I am satisfied that you shared this useful info with us. Please stay us informed like this. Thank you for sharing.

Someone essentially help to make seriously articles I would state. This is the first time I frequented your web page and thus far? I surprised with the research you made to create this particular publish amazing. Fantastic job!

Hello! Would you mind if I share your blog with my zynga group? There’s a lot of folks that I think would really enjoy your content. Please let me know. Thanks

My brother recommended I might like this website. He was totally right. This post truly made my day. You can not imagine just how much time I had spent for this information! Thanks!

Hey! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing several weeks of hard work due to no back up. Do you have any methods to prevent hackers?

Someone necessarily assist to make critically articles I might state. That is the very first time I frequented your web page and up to now? I surprised with the analysis you made to make this actual post extraordinary. Great job!

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

Very nice post. I just stumbled upon your weblog and wanted to say that I have truly enjoyed surfing around your blog posts. After all I’ll be subscribing to your rss feed and I hope you write again soon!

There is obviously a bunch to realize about this. I suppose you made some good points in features also.

A lot of thanks for all your valuable hard work on this site. My mum takes pleasure in carrying out research and it’s easy to see why. All of us notice all relating to the dynamic mode you create powerful tips through this web blog and therefore invigorate participation from visitors on that area then our child is truly being taught a whole lot. Take advantage of the remaining portion of the new year. You’re the one carrying out a splendid job.

I like this site very much, Its a rattling nice billet to read and find information.

Zu gesellschaftlichen Anlässen und Feiern wurden allerdings auswärtige Gäste oder Kurgäste eingeladen.

Über Generationen hinweg habe es das kulturelle und

gesellschaftliche Leben Wiesbadens geprägt. Geschäftsführer Andreas Krautwald betonte, dass die erfolgreiche Kooperation mit der

Landeshauptstadt fortgesetzt werde und man den eingeschlagenen Weg konsequent weitergehen wolle.

Über die Jahrhunderte hinweg entwickelte sich die Spielbank zu einem festen Treffpunkt des gesellschaftlichen Lebens.

Das Gebäude der Wiesbadener Casino-Gesellschaft liegt im Zentrum der Stadt in unmittelbarer Nähe zu renommierten Hotels.

1945 nahmen die Amerikaner und die deutsche Polizei von dem Anwesen Besitz und gaben es erst 1950 teilweise, 1954 wieder ganz frei.

Auch das Erwachen und Wachsen eines deutschen Nationalbewusstseins

hat möglicherweise eine nicht unerhebliche Rolle gespielt.

Ihr Zweck war auf die gesellschaftliche Unterhaltung,

wissenschaftliche Information und kulturelle Veranstaltungen gerichtet.

References:

https://online-spielhallen.de/admiral-casino-mobile-app-dein-umfassender-leitfaden/

Finding the best online casino Australia has to offer in 2025 involves more

than just flashy graphics—it’s about

trust, security, and game variety. All reputable online casinos offer tools and

resources to help you stay in control. While playing online pokies for real money can be entertaining, it’s crucial to approach it with a focus

on fun and control. Ultimately, it ensures a more enjoyable and secure online

casino games experience. Today, its popularity extends

across online casinos in Australia thanks to digital versions and

live dealer tables. No list of online casino games would be

complete without pokies.

Australian top casinos have also done the

same because of the benefits that come with crypto gambling.

However, few casinos in Australia have this bonus incentive.

The casino will instead offer you the bonus absolutely free!

Even so, it’s slowly entering the Australian online gambling space.

This was the biggest payout from an online casino.

For example, pokies are widely available in New South Wales and Queensland but restricted

to casinos in Western Australia. Once confirmed, you are ready to use your bonus funds

on eligible games. Pick a reputable online casino from our recommended

list.

Some VPN-Friendly casinos let you encrypt your traffic and protect your identity – a

real game-changer for Aussie players looking for

an extra layer of privacy. We review the privacy policies of online casinos

to ensure they comply with strict data protection regulations and industry

standards. That doesn’t mean No KYC casinos aren’t safe,

but if you want to play without leaving a trace of your identity online, it’s best to trust our expert testing first.

References:

https://blackcoin.co/no-deposit-casino-bonuses-for-australia-free-spins-signup-cash-offers/

paypal online casinos

References:

careerterms.com

paypal casino usa

References:

ptshop.co.kr

I am not sure the place you are getting your info, however good topic. I must spend a while learning much more or understanding more. Thank you for excellent info I was in search of this information for my mission.

I think this is among the most significant info for me. And i’m glad reading your article. But should remark on some general things, The site style is wonderful, the articles is really great : D. Good job, cheers

You are a very intelligent individual!