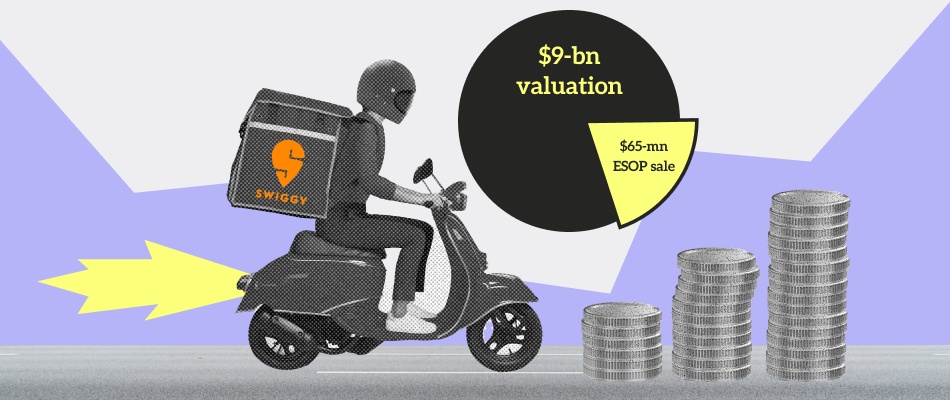

Swiggy offers $65 million ESOP buyback before its IPO: Check eligibility, taxation

New Delhi: Swiggy has announced a $50 million ESOP buyback plan for its employees ahead of its anticipated IPO. This buyback will involve approximately 2,000 employees, including those from Dineout, which Swiggy recently acquired. The initiative is part of Swiggy’s ongoing efforts to reward and retain talent, marking the fifth ESOP buyback since 2018

Eligibility and Participation

Eligible employees include those who hold ESOPs granted by Swiggy. The company has previously implemented programs like the “Build Your Own Dollar” (BYOD), which allows all permanent employees to invest in Swiggy’s ESOPs, expanding participation beyond higher-grade or performance-based criteria

Taxation

The taxation on ESOPs generally includes two phases:

- At the time of exercising the options: The difference between the exercise price and the fair market value of the shares is taxed as perquisites under the head ‘Salary’.

- At the time of sale: The gains are taxed as capital gains. If the shares are held for more than 24 months, they qualify for long-term capital gains tax, which may be eligible for indexation benefits.

These regulations may vary, and employees should consult with a tax advisor to understand their specific tax liabilities.

Follow for more information.

Very interesting information!Perfect just what I was searching for!

When I initially commented I clicked the -Notify me when new comments are added- checkbox and now each time a remark is added I get 4 emails with the same comment. Is there any approach you possibly can take away me from that service? Thanks!

在这里下载Telegram官网最新版,适用于所有主流操作系统。本站为你提供详细的纸飞机使用指南,包括如何下载、安装以及设置中文界面,帮助你轻松使用这一全球领先的通讯 https://www.telegrambbs.com

magnificent points altogether, you just won a new reader. What could you recommend about your put up that you simply made some days in the past? Any certain?

Good info. Lucky me I reach on your website by accident, I bookmarked it.

This actually answered my problem, thanks!